install.packages("forecast")Installing package into ‘/home/coco/R/x86_64-pc-linux-gnu-library/4.2’

(as ‘lib’ is unspecified)

Warning message in install.packages("forecast"):

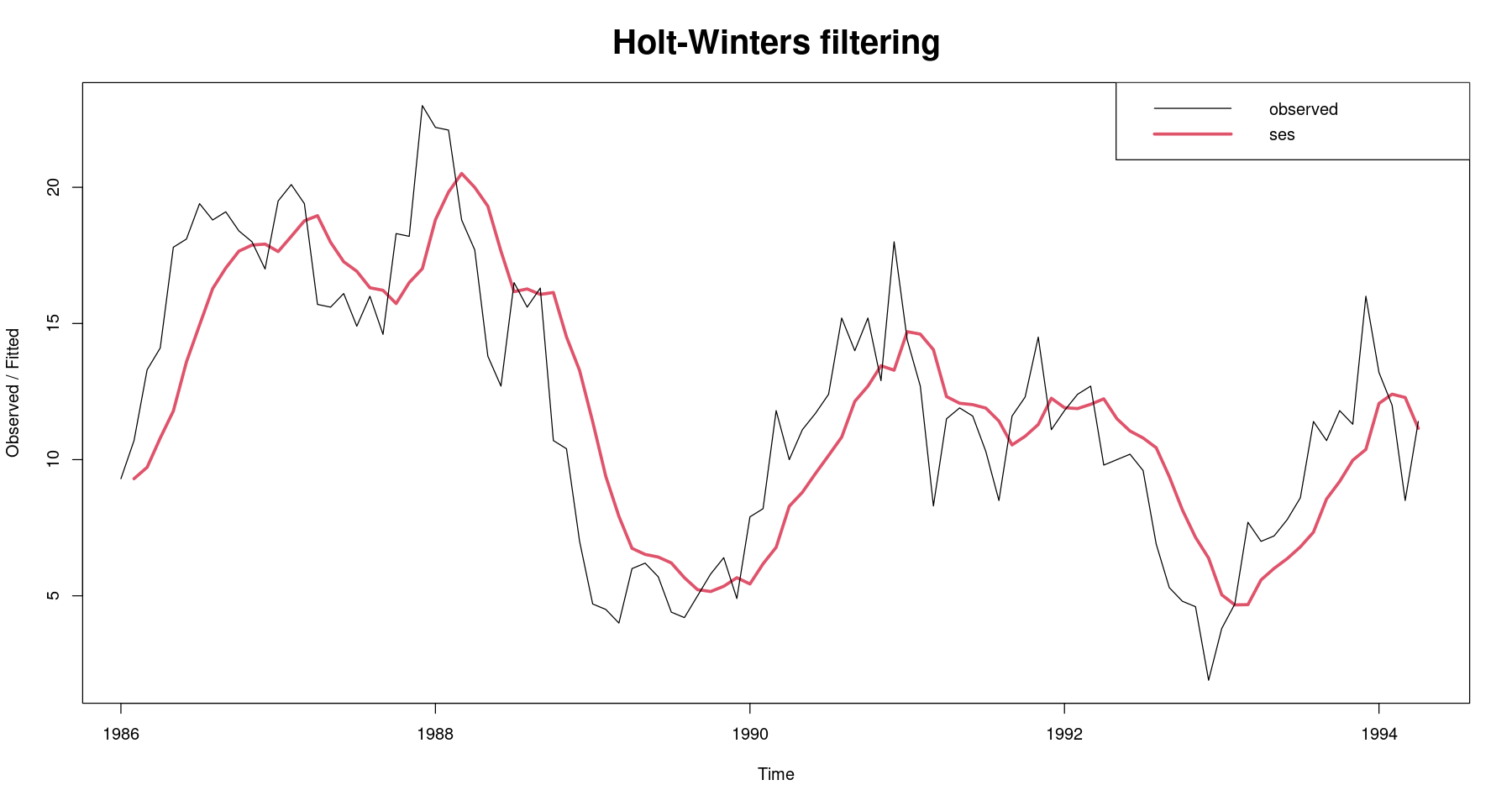

“installation of package ‘forecast’ had non-zero exit status”fit0 <- HoltWinters(mindex,

alpha=0.3,

beta=FALSE,

gamma=FALSE)fit0Holt-Winters exponential smoothing without trend and without seasonal component.

Call:

HoltWinters(x = mindex, alpha = 0.3, beta = FALSE, gamma = FALSE)

Smoothing parameters:

alpha: 0.3

beta : FALSE

gamma: FALSE

Coefficients:

[,1]

a 11.2236coefficeints: 마지막 관측값(평활값)에 대한 값이 예측값이 되는것.

예측갱신

tail(fit0$fitted)| xhat | level | |

|---|---|---|

| Nov 1993 | 9.97951 | 9.97951 |

| Dec 1993 | 10.37566 | 10.37566 |

| Jan 1994 | 12.06296 | 12.06296 |

| Feb 1994 | 12.40407 | 12.40407 |

| Mar 1994 | 12.28285 | 12.28285 |

| Apr 1994 | 11.14800 | 11.14800 |

coefficients: 11.14800 마지막 평활값

ls(fit0)head(fit0$fitted) ## 평활값| xhat | level | |

|---|---|---|

| Feb 1986 | 9.30000 | 9.30000 |

| Mar 1986 | 9.72000 | 9.72000 |

| Apr 1986 | 10.79400 | 10.79400 |

| May 1986 | 11.78580 | 11.78580 |

| Jun 1986 | 13.59006 | 13.59006 |

| Jul 1986 | 14.94304 | 14.94304 |

head(cbind(fit0$fitted, mindex))| fit0$fitted.xhat | fit0$fitted.level | mindex | |

|---|---|---|---|

| Jan 1986 | NA | NA | 9.3 |

| Feb 1986 | 9.30000 | 9.30000 | 10.7 |

| Mar 1986 | 9.72000 | 9.72000 | 13.3 |

| Apr 1986 | 10.79400 | 10.79400 | 14.1 |

| May 1986 | 11.78580 | 11.78580 | 17.8 |

| Jun 1986 | 13.59006 | 13.59006 | 18.1 |

관측 값이 쌓여야 해 ~

단순지수평활통계량

0.3*10.7 + 0.7*9.30.3*13.3 + 0.3*0.7*10.7 + 0.7*0.7*9.3fit0$SSEplot(fit0, lwd=3, cex.main = 2)

legend("topright", legend=c("observed", "ses"), lty=1,lwd=c(1,3), col=1:2)

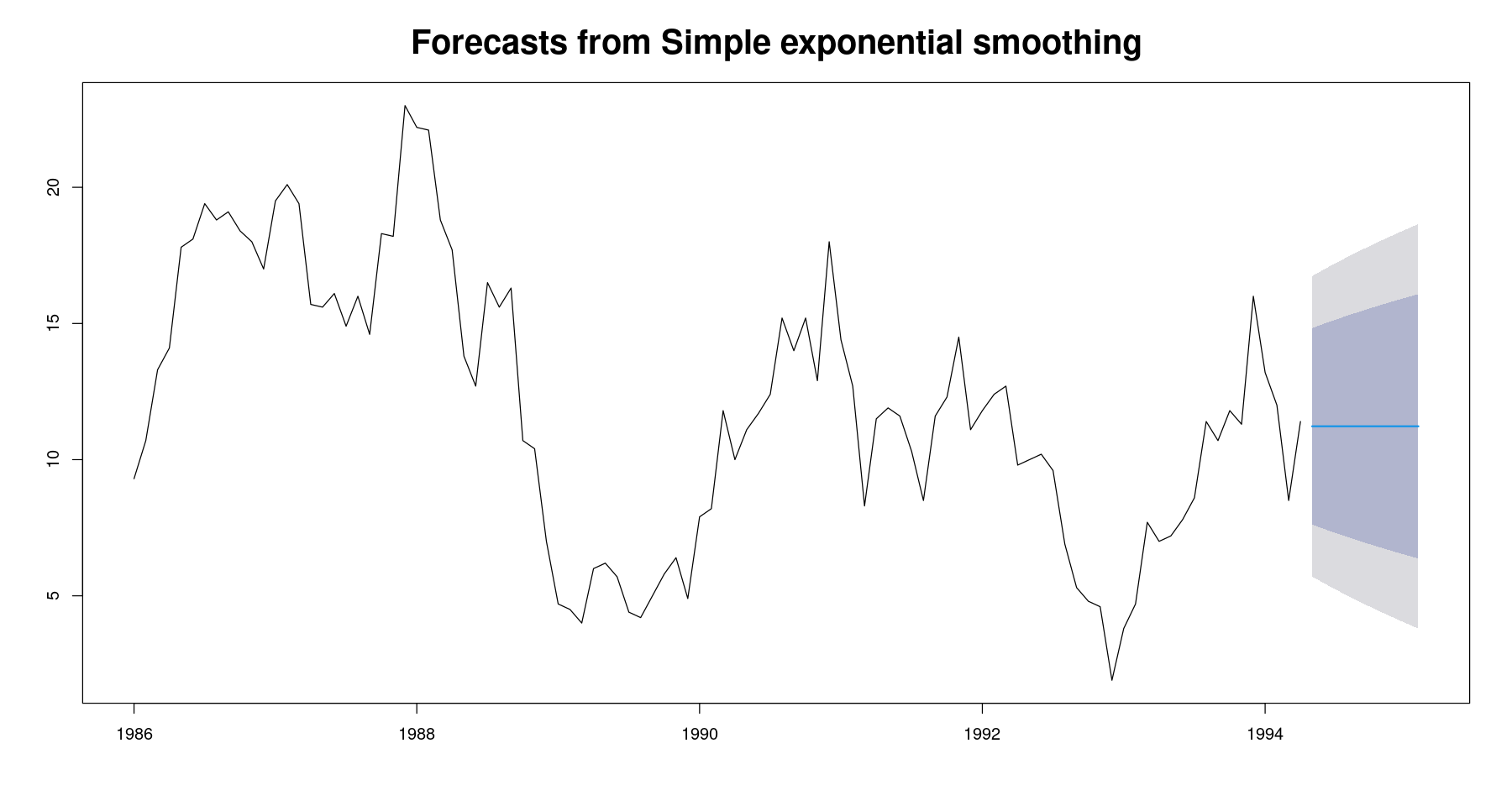

fit01 <- ses(mindex,

alpha = 0.3,

initial = 'simple',

h = 10) ##Exponential smoothing forecastsses: 단순지수평활만 가능한 함수

h: 마지막 데이터 이후 앞으로 예측하고 싶은 구간

fit01 Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

May 1994 11.2236 7.614786 14.83241 5.704397 16.74280

Jun 1994 11.2236 7.455888 14.99131 5.461383 16.98581

Jul 1994 11.2236 7.303425 15.14377 5.228212 17.21898

Aug 1994 11.2236 7.156674 15.29052 5.003775 17.44342

Sep 1994 11.2236 7.015037 15.43216 4.787159 17.66003

Oct 1994 11.2236 6.878013 15.56918 4.577601 17.86959

Nov 1994 11.2236 6.745181 15.70201 4.374450 18.07274

Dec 1994 11.2236 6.616176 15.83102 4.177155 18.27004

Jan 1995 11.2236 6.490686 15.95651 3.985235 18.46196

Feb 1995 11.2236 6.368439 16.07875 3.798273 18.64892ls(fit01)summary(fit01)

Forecast method: Simple exponential smoothing

Model Information:

Simple exponential smoothing

Call:

ses(y = mindex, h = 10, initial = "simple", alpha = 0.3)

Smoothing parameters:

alpha = 0.3

Initial states:

l = 9.3

sigma: 2.816

Error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 0.06411989 2.81597 2.248923 -7.657492 24.93904 0.4105067 0.6648489

Forecasts:

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

May 1994 11.2236 7.614786 14.83241 5.704397 16.74280

Jun 1994 11.2236 7.455888 14.99131 5.461383 16.98581

Jul 1994 11.2236 7.303425 15.14377 5.228212 17.21898

Aug 1994 11.2236 7.156674 15.29052 5.003775 17.44342

Sep 1994 11.2236 7.015037 15.43216 4.787159 17.66003

Oct 1994 11.2236 6.878013 15.56918 4.577601 17.86959

Nov 1994 11.2236 6.745181 15.70201 4.374450 18.07274

Dec 1994 11.2236 6.616176 15.83102 4.177155 18.27004

Jan 1995 11.2236 6.490686 15.95651 3.985235 18.46196

Feb 1995 11.2236 6.368439 16.07875 3.798273 18.64892tail(cbind(fit0$fitted, mindex))| fit0$fitted.xhat | fit0$fitted.level | mindex | |

|---|---|---|---|

| Nov 1993 | 9.97951 | 9.97951 | 11.3 |

| Dec 1993 | 10.37566 | 10.37566 | 16.0 |

| Jan 1994 | 12.06296 | 12.06296 | 13.2 |

| Feb 1994 | 12.40407 | 12.40407 | 12.0 |

| Mar 1994 | 12.28285 | 12.28285 | 8.5 |

| Apr 1994 | 11.14800 | 11.14800 | 11.4 |

- 예측 갱신

0.3*11.4+0.7*11.148000.3*11.4+0.7*11.147995summary(fit01)

Forecast method: Simple exponential smoothing

Model Information:

Simple exponential smoothing

Call:

ses(y = mindex, h = 10, initial = "simple", alpha = 0.3)

Smoothing parameters:

alpha = 0.3

Initial states:

l = 9.3

sigma: 2.816

Error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 0.06411989 2.81597 2.248923 -7.657492 24.93904 0.4105067 0.6648489

Forecasts:

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

May 1994 11.2236 7.614786 14.83241 5.704397 16.74280

Jun 1994 11.2236 7.455888 14.99131 5.461383 16.98581

Jul 1994 11.2236 7.303425 15.14377 5.228212 17.21898

Aug 1994 11.2236 7.156674 15.29052 5.003775 17.44342

Sep 1994 11.2236 7.015037 15.43216 4.787159 17.66003

Oct 1994 11.2236 6.878013 15.56918 4.577601 17.86959

Nov 1994 11.2236 6.745181 15.70201 4.374450 18.07274

Dec 1994 11.2236 6.616176 15.83102 4.177155 18.27004

Jan 1995 11.2236 6.490686 15.95651 3.985235 18.46196

Feb 1995 11.2236 6.368439 16.07875 3.798273 18.64892plot(fit01,, cex.main = 2)

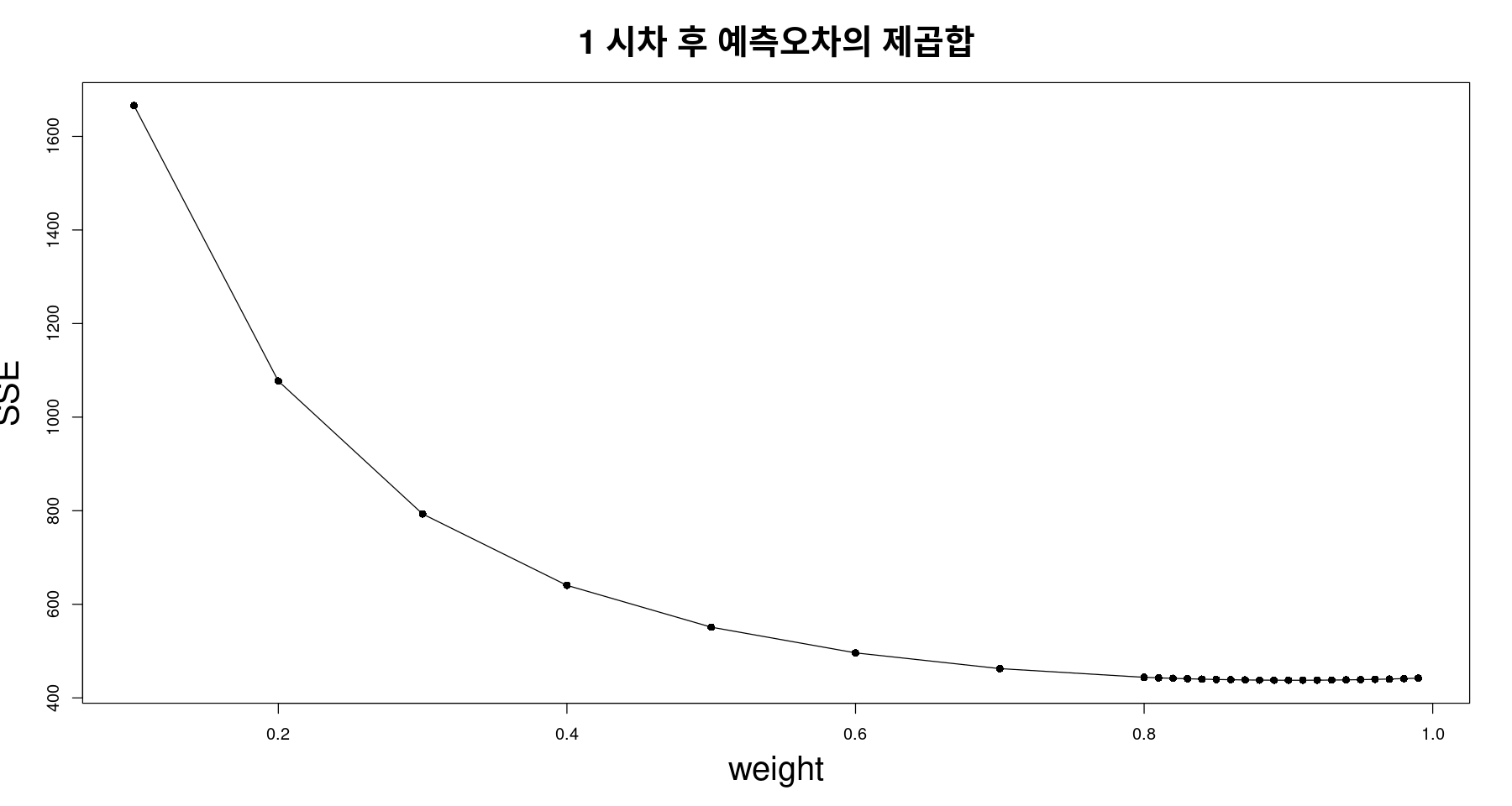

w <-c(seq(0.1,0.8,0.1), seq(0.81, 0.99, 0.01))SSE_ses <- sapply(w, function(alpha) HoltWinters(mindex,

alpha=alpha,

beta=FALSE,

gamma=FALSE)$SSE)

plot(w,SSE_ses, type="o", xlab="weight", ylab="SSE", pch=16,

main="1 시차 후 예측오차의 제곱합",

cex.main = 2, cex.lab=2)

- SSE를 가장 작게 하는 값 찾자

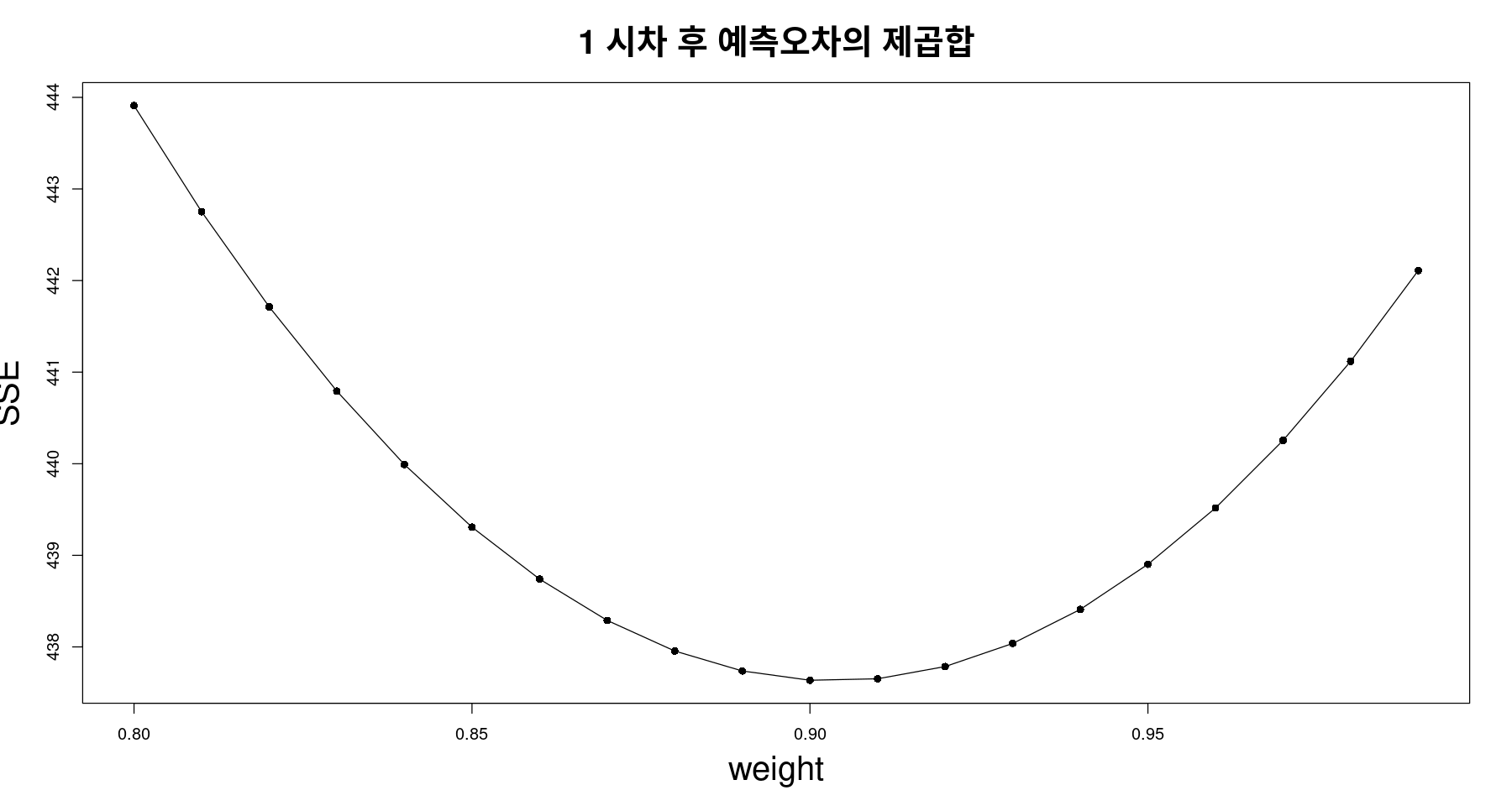

which.min(SSE_ses)w[which.min(SSE_ses)]plot(w[-(1:7)],SSE_ses[-(1:7)], type="o", xlab="weight", ylab="SSE", pch=16,

main="1 시차 후 예측오차의 제곱합",

cex.main = 2, cex.lab=2)

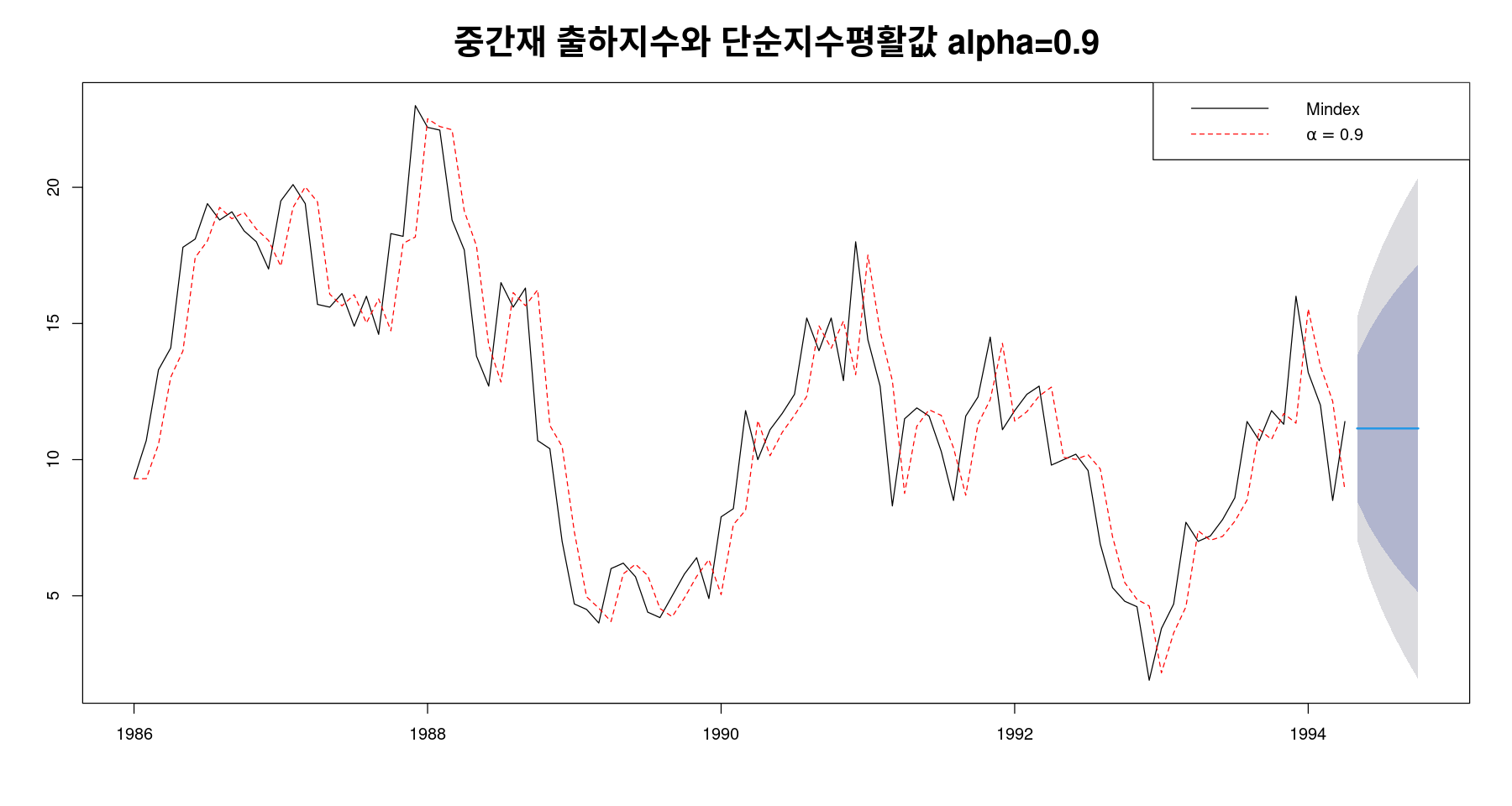

fit1 <- ses(mindex, alpha=w[which.min(SSE_ses)], initial = "simple", h=6)plot(fit1, xlab="", ylab="",

main="중간재 출하지수와 단순지수평활값 alpha=0.9",

lty=1,col="black",

cex.main = 2, cex.lab=2 )

lines(fitted(fit1), col="red", lty=2)

legend("topright", legend=c("Mindex", expression(alpha==0.9)),

lty=1:2,col=c("black","red"))

fit0_w <- HoltWinters(mindex,

beta=FALSE,

gamma=FALSE)

fit0_wHolt-Winters exponential smoothing without trend and without seasonal component.

Call:

HoltWinters(x = mindex, beta = FALSE, gamma = FALSE)

Smoothing parameters:

alpha: 0.9036403

beta : FALSE

gamma: FALSE

Coefficients:

[,1]

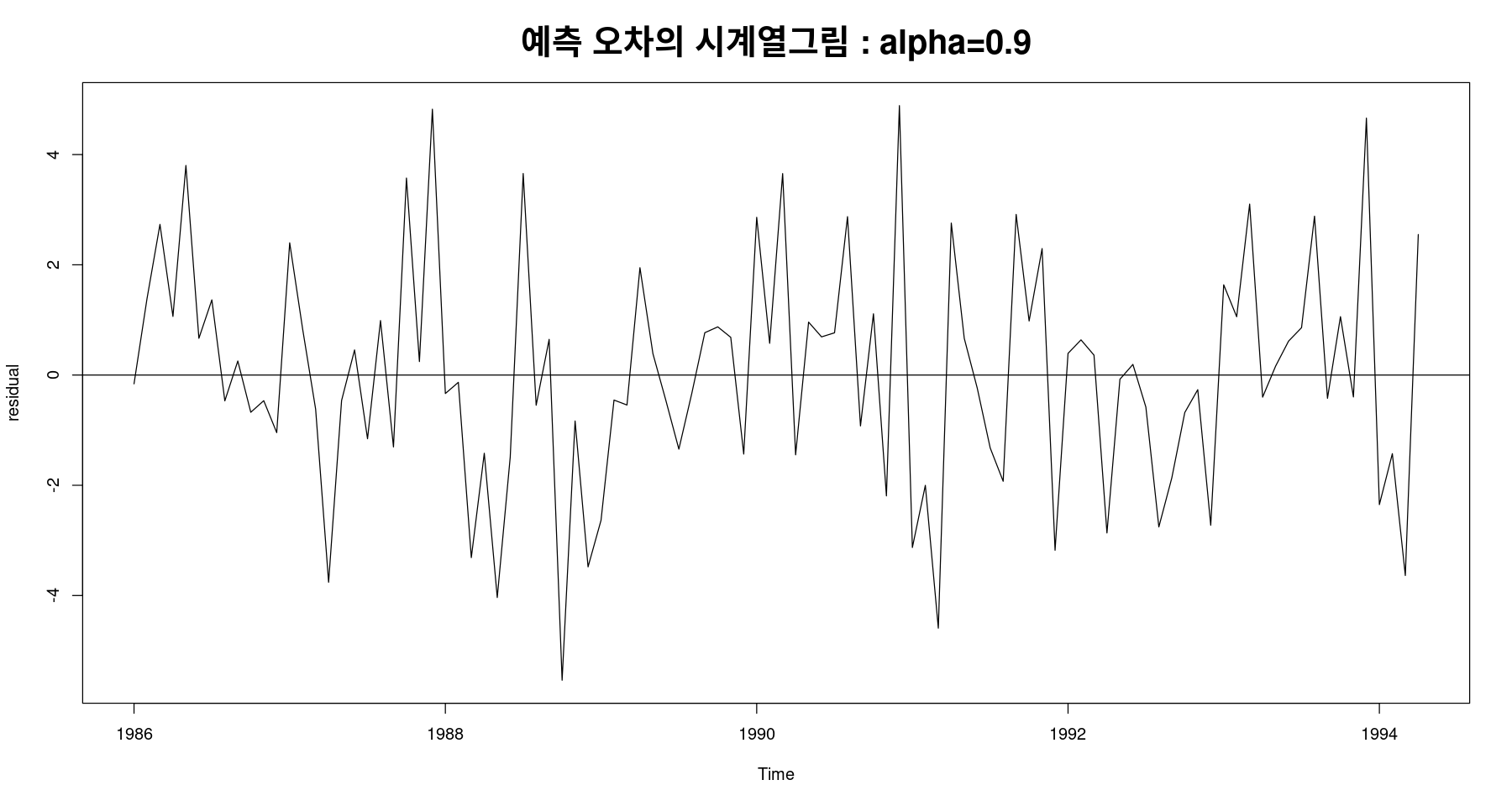

a 11.15433fit1 <- ses(mindex, alpha=fit0_w$alpha, h=12)ls(fit1)plot(fit1$residuals, ylab="residual",

main="예측 오차의 시계열그림 : alpha=0.9",

cex.main = 2, cex.lab=2); abline(h=0)

t.test(fit1$residual)

One Sample t-test

data: fit1$residual

t = 0.089225, df = 99, p-value = 0.9291

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.3983934 0.4359099

sample estimates:

mean of x

0.01875828 귀무가설을 기각할 수 없음. 평균은 0이다.

dwtest(lm(fit1$residual~1))

Durbin-Watson test

data: lm(fit1$residual ~ 1)

DW = 2.0244, p-value = 0.549

alternative hypothesis: true autocorrelation is greater than 0dwtest에는 회귀모형이 들어가야 함.

dwtest(lm(fit1$residual~1), alternative = "two.sided")

Durbin-Watson test

data: lm(fit1$residual ~ 1)

DW = 2.0244, p-value = 0.902

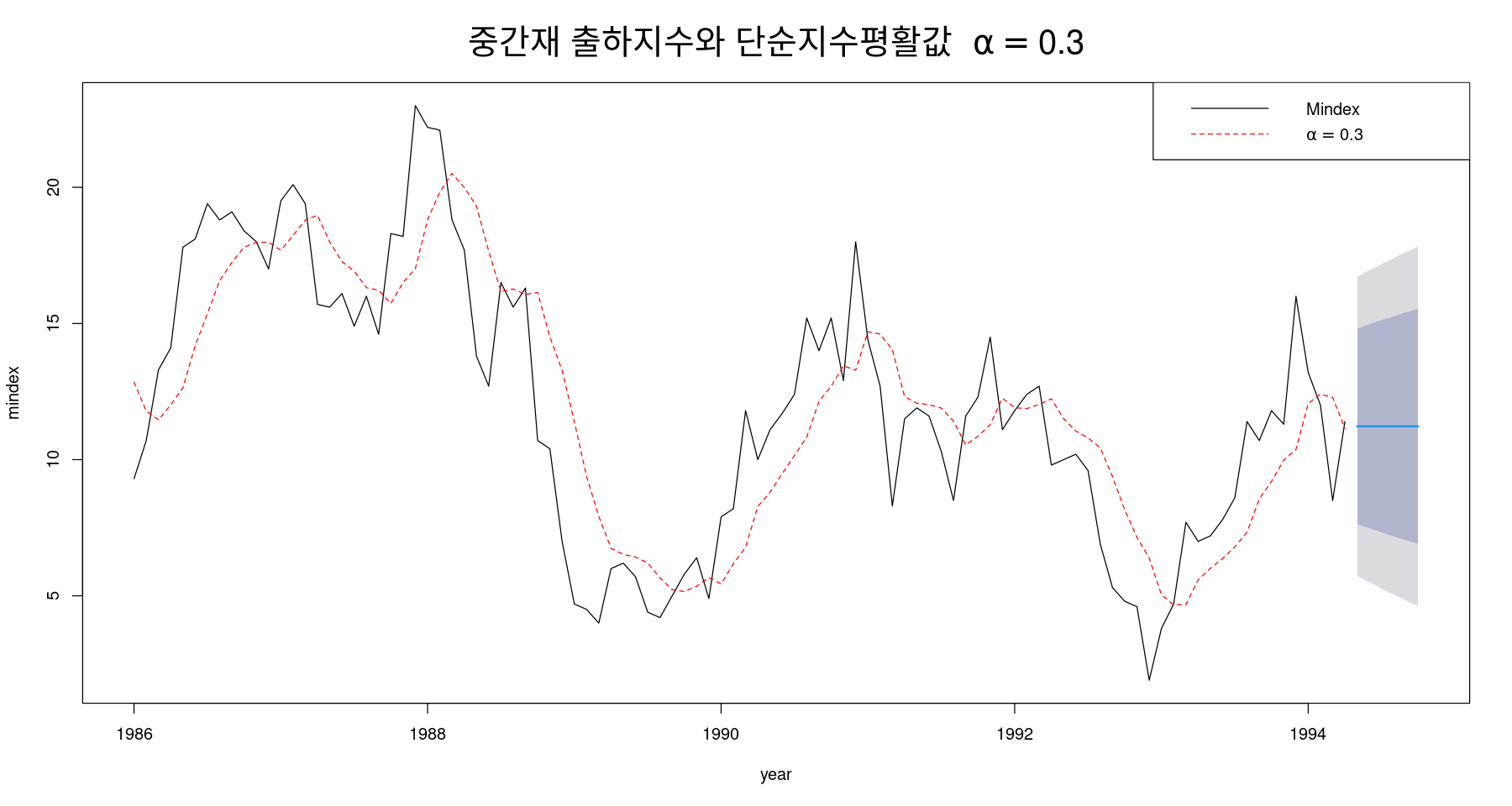

alternative hypothesis: true autocorrelation is not 0fit2 <- ses(mindex, alpha=0.3, h=6)

plot(fit2, xlab="year", ylab="mindex",

main=expression("중간재 출하지수와 단순지수평활값 "~alpha==0.3),

lty=1,col="black",

cex.main = 2,

cex.lab=2)

lines(fitted(fit2), col="red", lty=2)

legend("topright",

legend=c("Mindex",expression(alpha==0.3)),

lty=1:2,

col=c("black","red"))

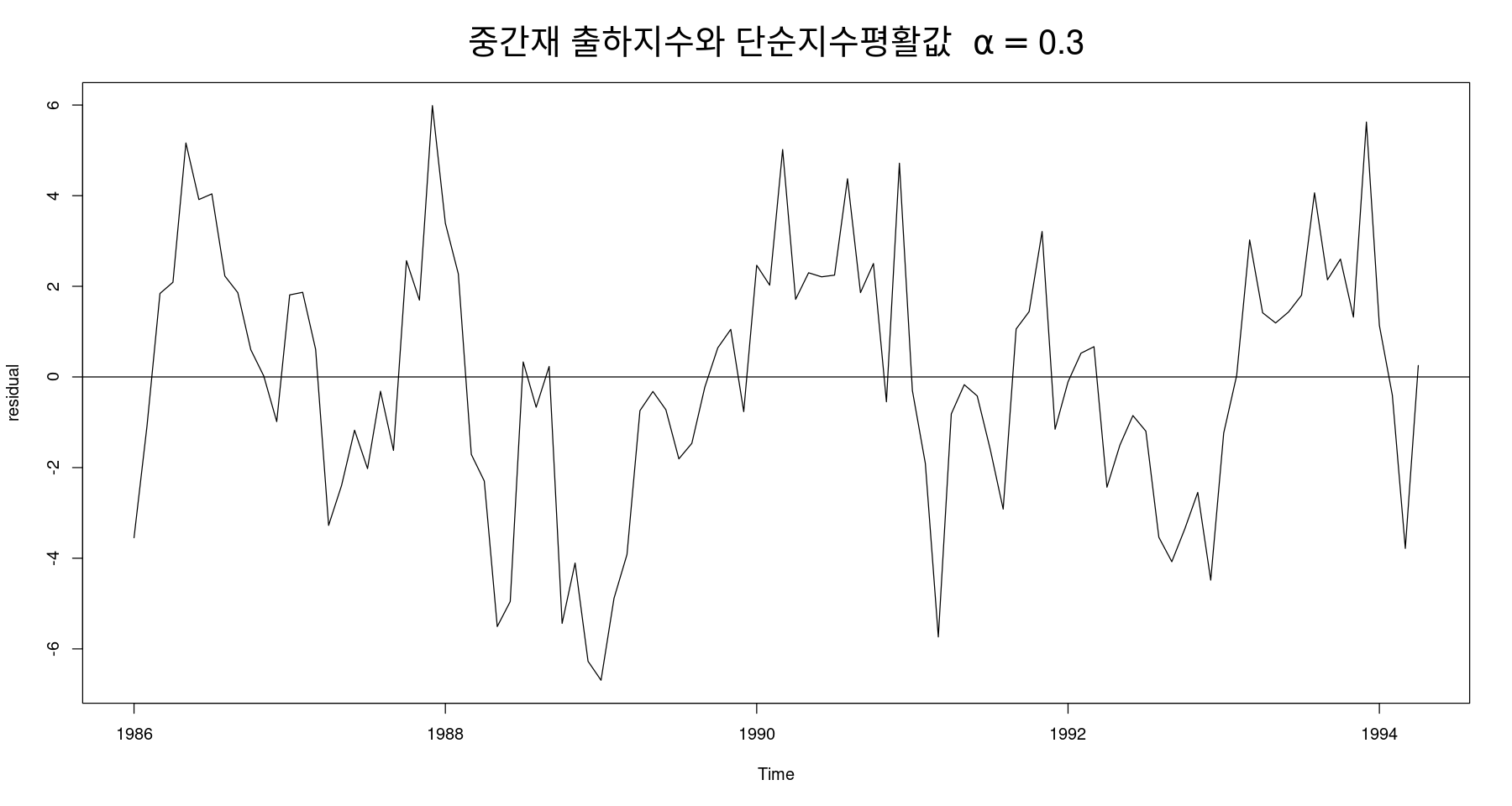

plot(fit2$residuals, ylab="residual",

main=expression("중간재 출하지수와 단순지수평활값 "~alpha==0.3),

cex.main = 2,

cex.lab=2); abline(h=0)

오차의 평균이 0인가?

t.test(fit2$residual)

One Sample t-test

data: fit2$residual

t = -0.19433, df = 99, p-value = 0.8463

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.6067721 0.4985236

sample estimates:

mean of x

-0.05412425 오차가 독립인가?

dwtest(lm(fit2$residual~1))

Durbin-Watson test

data: lm(fit2$residual ~ 1)

DW = 0.70285, p-value = 2.853e-11

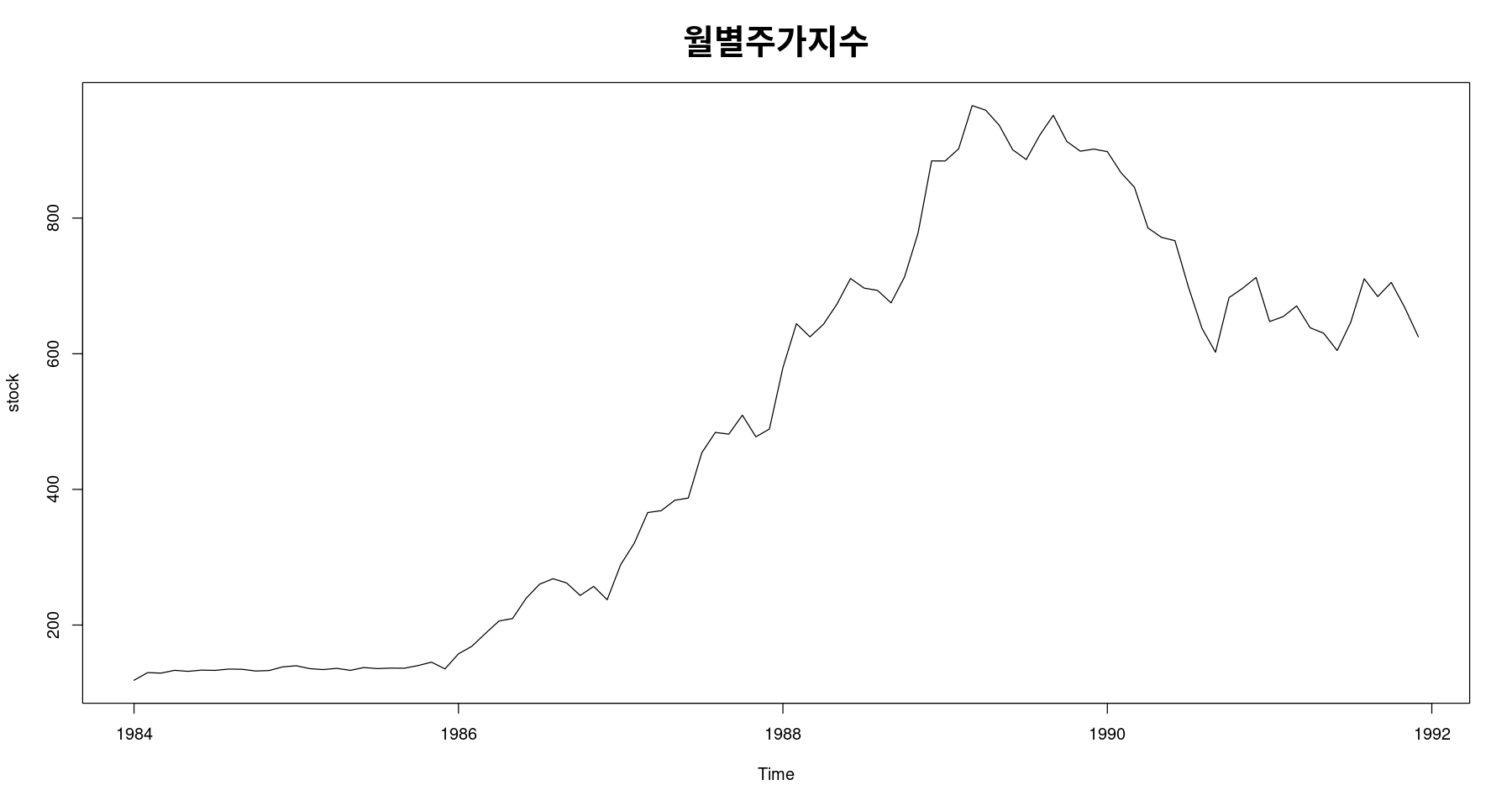

alternative hypothesis: true autocorrelation is greater than 0z <- scan("stock.txt")

stock <- ts(z, start=c(1984,1), frequency=12)plot(stock, main = '월별주가지수', cex.main=2, cex.lab=2)

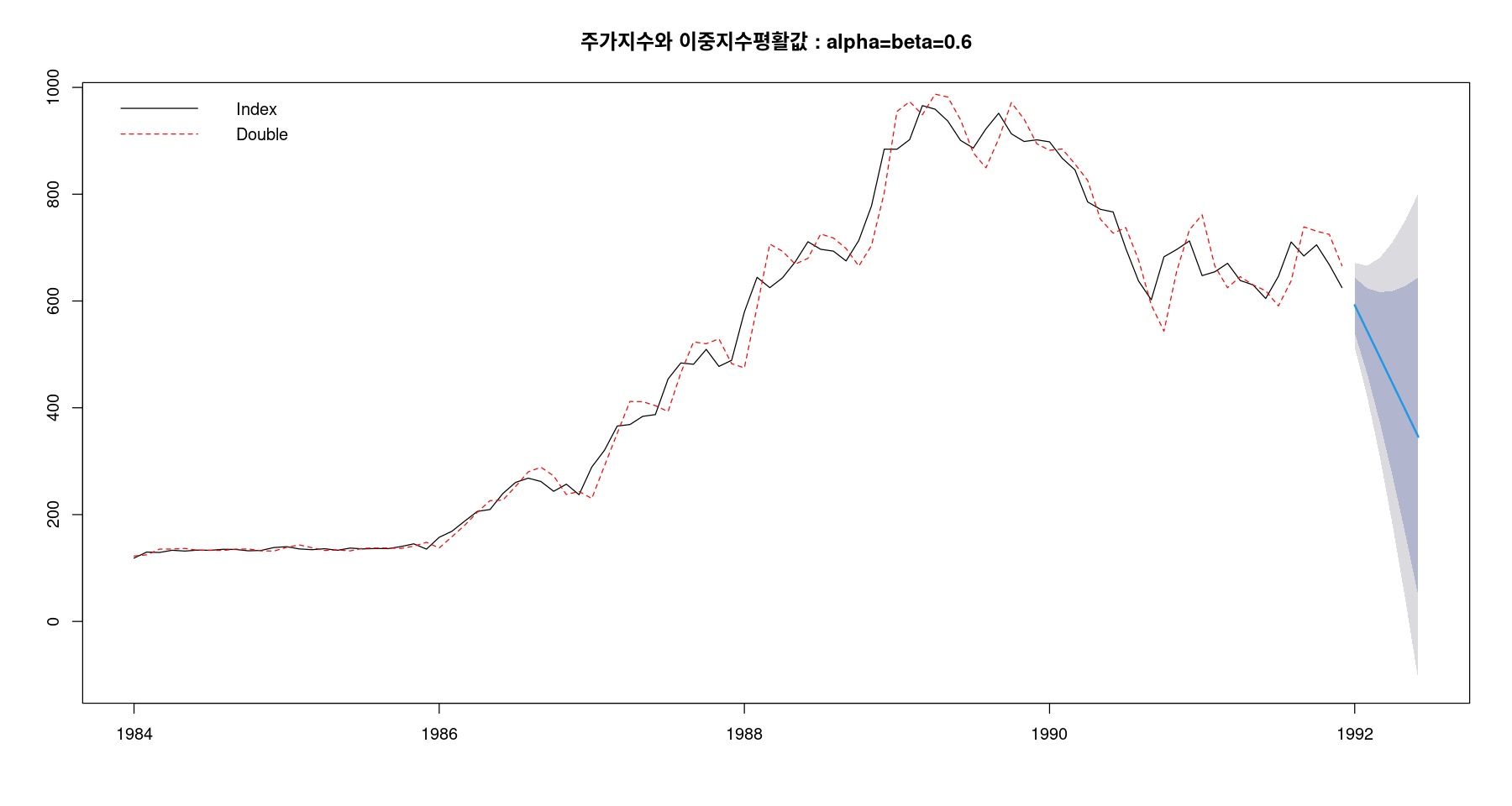

fit4 = holt(stock, alpha=0.6, beta=0.6, h=6)

fit4$modelHolt's method

Call:

holt(y = stock, h = 6, alpha = 0.6, beta = 0.6)

Smoothing parameters:

alpha = 0.6

beta = 0.6

Initial states:

l = 115.6009

b = 6.8098

sigma: 40.2546

AIC AICc BIC

1149.575 1149.836 1157.268 plot(fit4, ylab="", xlab="", lty=1, col="black",

main="주가지수와 이중지수평활값 : alpha=beta=0.6"

)

lines(fitted(fit4), col="red", lty=2)

legend("topleft", lty=1:2, col=c("black","red"), c("Index", "Double"), bty = "n")

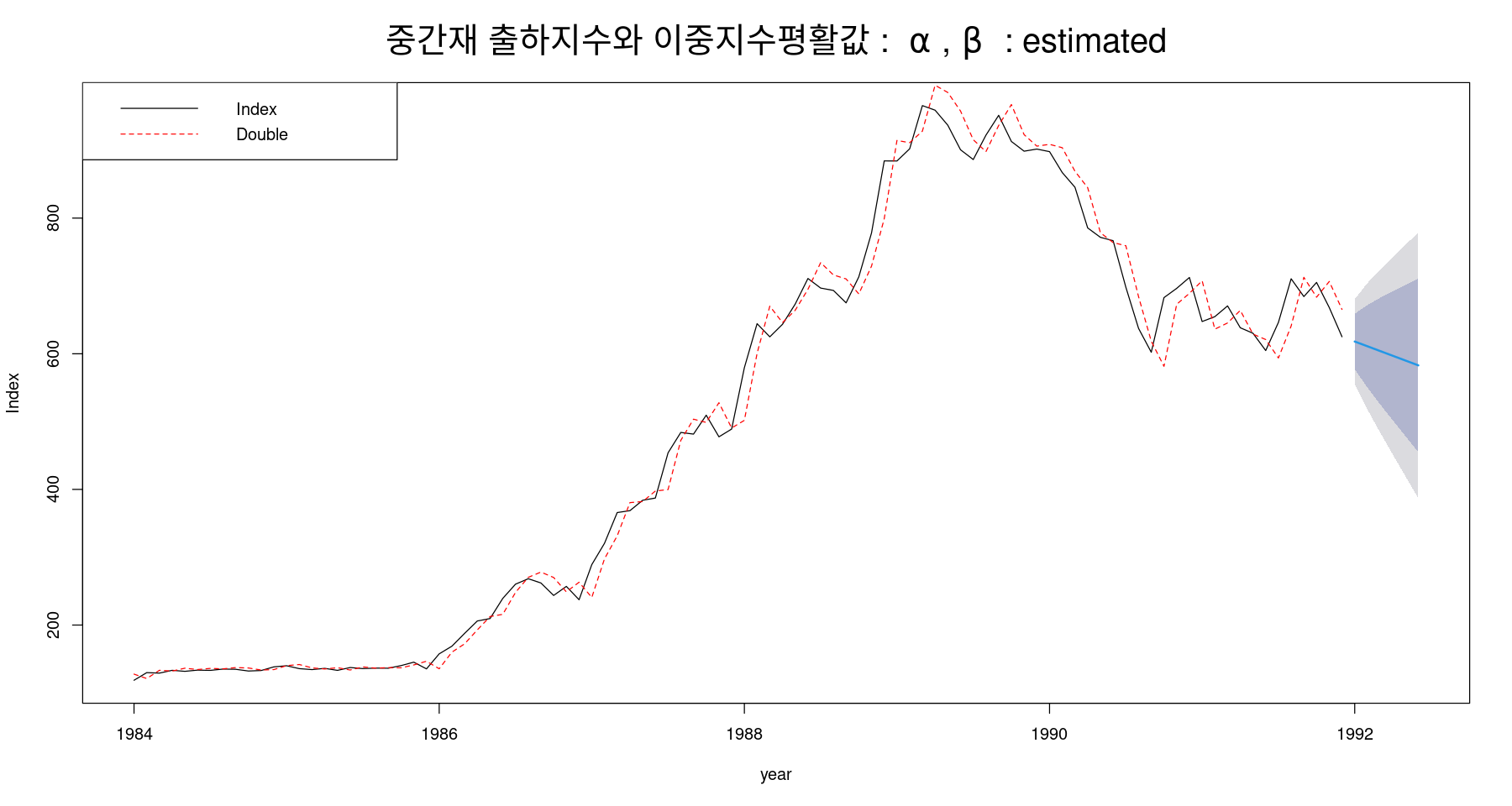

fit5 = holt(stock, h=6)

fit5$modelHolt's method

Call:

holt(y = stock, h = 6)

Smoothing parameters:

alpha = 0.9999

beta = 0.1071

Initial states:

l = 124.1137

b = 3.4954

sigma: 31.8609

AIC AICc BIC

1108.677 1109.343 1121.498 fit50 <- HoltWinters(stock,

gamma = FALSE)fit50Holt-Winters exponential smoothing with trend and without seasonal component.

Call:

HoltWinters(x = stock, gamma = FALSE)

Smoothing parameters:

alpha: 1

beta : 0.1094451

gamma: FALSE

Coefficients:

[,1]

a 625.060000

b -7.097122predict(fit50, n.ahead=12, prediction.interval = T, level=0.95) | fit | upr | lwr | |

|---|---|---|---|

| Jan 1992 | 617.9629 | 680.0626 | 555.8631 |

| Feb 1992 | 610.8658 | 703.6185 | 518.1130 |

| Mar 1992 | 603.7686 | 723.4869 | 484.0504 |

| Apr 1992 | 596.6715 | 742.0570 | 451.2860 |

| May 1992 | 589.5744 | 760.1877 | 418.9611 |

| Jun 1992 | 582.4773 | 778.2851 | 386.6695 |

| Jul 1992 | 575.3801 | 796.5695 | 354.1907 |

| Aug 1992 | 568.2830 | 815.1705 | 321.3955 |

| Sep 1992 | 561.1859 | 834.1678 | 288.2040 |

| Oct 1992 | 554.0888 | 853.6121 | 254.5655 |

| Nov 1992 | 546.9917 | 873.5358 | 220.4475 |

| Dec 1992 | 539.8945 | 893.9596 | 185.8294 |

fit5 Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Jan 1992 618.0360 577.2045 658.8674 555.5897 680.4822

Feb 1992 611.0079 550.0961 671.9196 517.8514 704.1644

Mar 1992 603.9798 525.4452 682.5144 483.8715 724.0881

Apr 1992 596.9517 501.6745 692.2290 451.2377 742.6657

May 1992 589.9237 478.2155 701.6319 419.0807 760.7666

Jun 1992 582.8956 454.7987 710.9924 386.9883 778.8028- 시점 n에서 l-시차 후의 예측값

plot(fit5, ylab="Index", xlab="year", lty=1, col="black",

main=expression("중간재 출하지수와 이중지수평활값 : "~alpha~","~beta~ " : estimated"),

cex.main=2)

lines(fitted(fit5), col="red", lty=2)

legend("topleft", lty=1:2, col=c("black","red"), c("Index", "Double"))

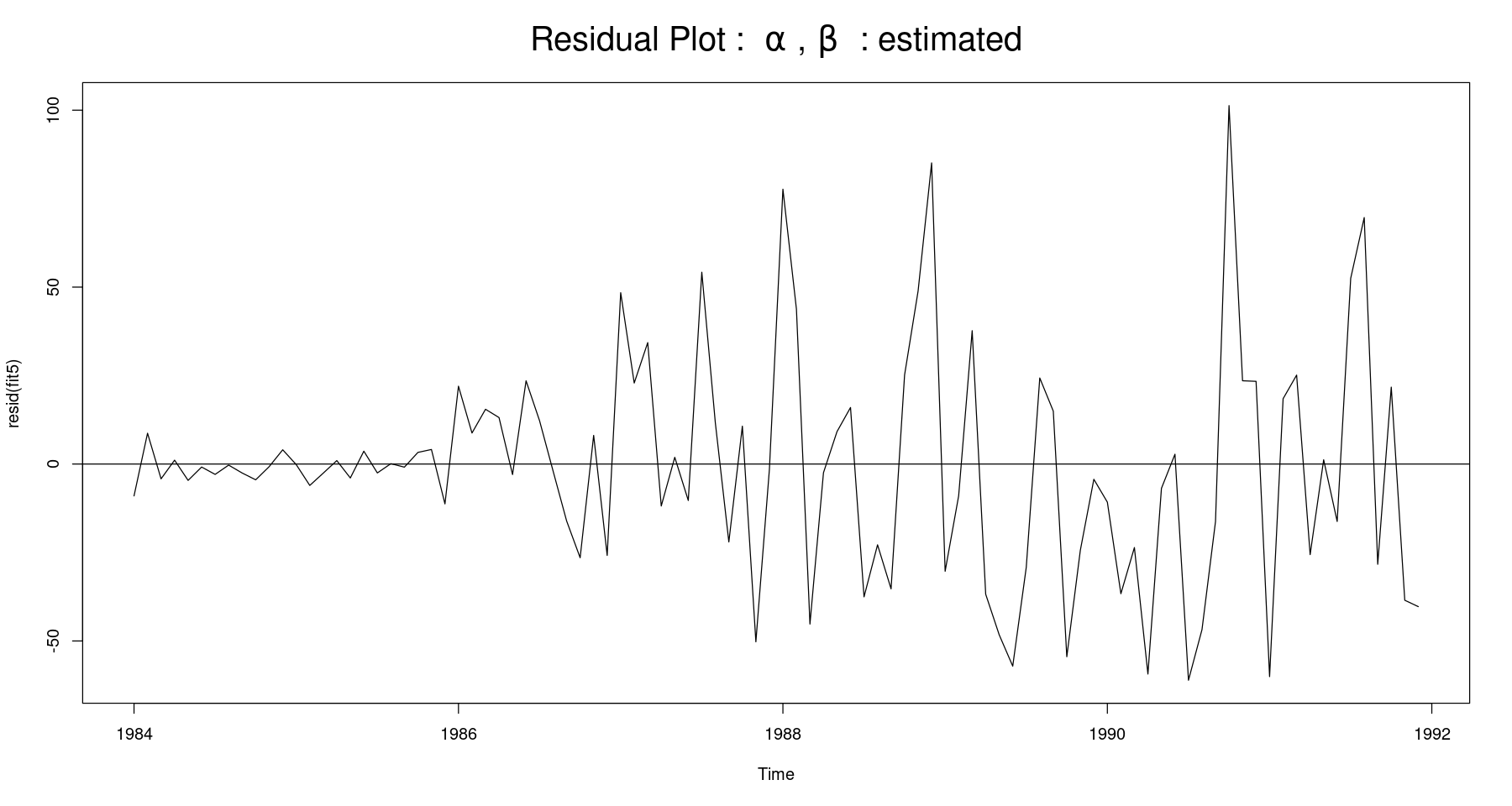

plot(resid(fit5), main=expression("Residual Plot : "~alpha~","~beta~ " : estimated"),

cex.main=2)

abline(h=0)

dwtest(lm(fit5$residuals~1), alternative = "two.sided")

Durbin-Watson test

data: lm(fit5$residuals ~ 1)

DW = 1.658, p-value = 0.09054

alternative hypothesis: true autocorrelation is not 0z <- scan("koreapass.txt")

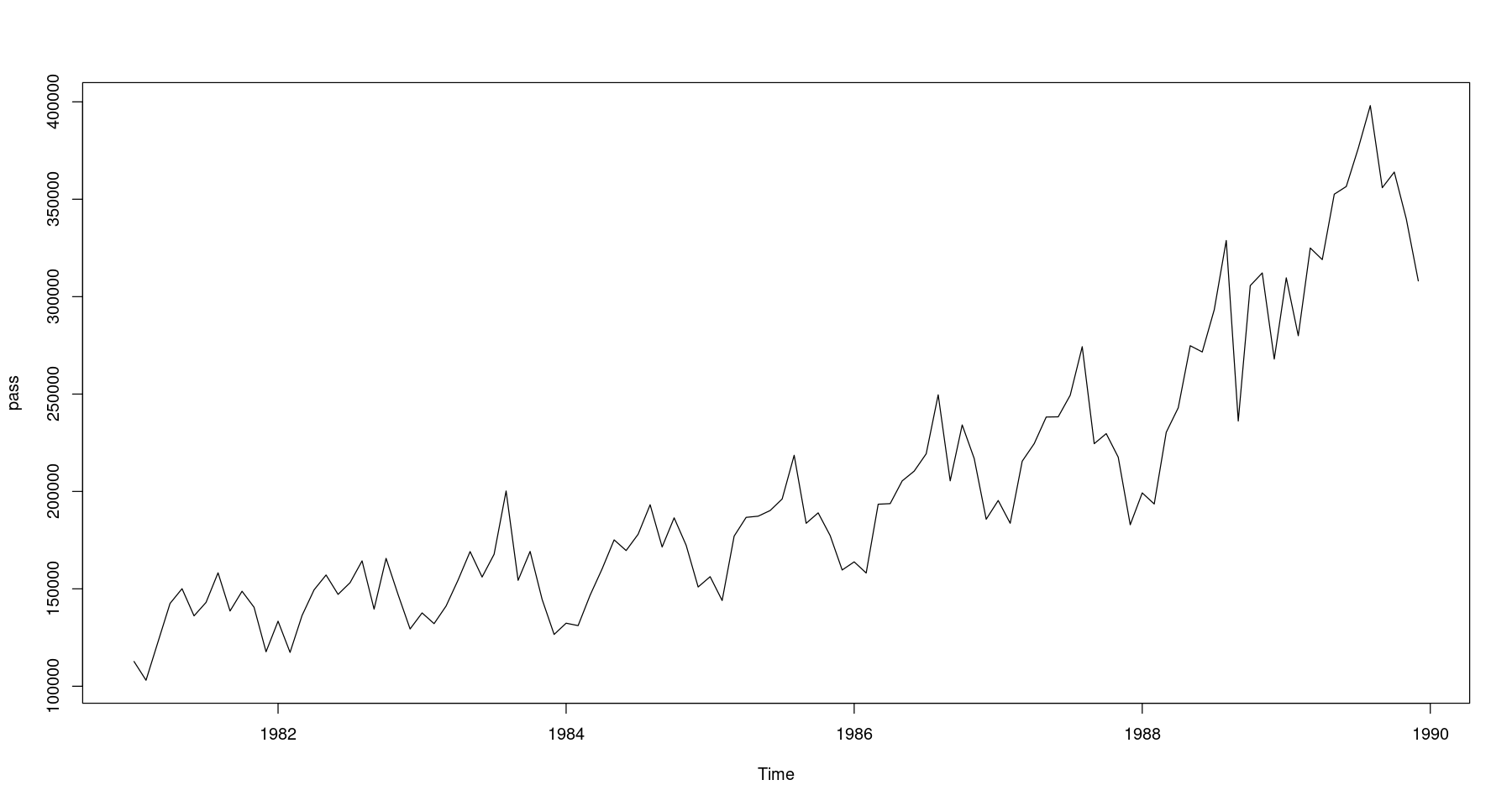

pass <- ts(z, start=c(1981,1), frequency=12)ts에 주기가 들어가 있어야 holtwinter에서 계절을 적합할 수 있다

plot.ts(pass)

가법 모형? 승법 모형? 무엇을 쓸지 정해줘야 함

fit_hw <- HoltWinters(pass, seasonal="additive") #default는 additivefit_hwHolt-Winters exponential smoothing with trend and additive seasonal component.

Call:

HoltWinters(x = pass, seasonal = "additive")

Smoothing parameters:

alpha: 0.4810767

beta : 0.0383379

gamma: 0.7345988

Coefficients:

[,1]

a 347794.753

b 3363.251

s1 -12186.666

s2 -33643.322

s3 4855.643

s4 5000.713

s5 29085.909

s6 22953.006

s7 32200.195

s8 49687.643

s9 -11655.430

s10 10218.813

s11 -4226.391

s12 -38683.394head(fit_hw$fitted)| xhat | level | trend | season | |

|---|---|---|---|---|

| Jan 1982 | 128208.0 | 135375.1 | 769.6180 | -7936.701 |

| Feb 1982 | 114877.0 | 138637.6 | 865.1923 | -24625.868 |

| Mar 1982 | 135627.2 | 140706.0 | 911.3201 | -5990.160 |

| Apr 1982 | 149303.2 | 141945.3 | 923.8952 | 6433.924 |

| May 1982 | 156969.9 | 142952.4 | 927.0829 | 13090.465 |

| Jun 1982 | 147259.4 | 143945.4 | 929.6108 | 2384.382 |

135375.1+769.6180-7936.701xhat = level + trend + season

- 계절지수평활 예측

plot(fit_hw, lwd=2)

predict(fit_hw, n.ahead=12, prediction.interval = T, level=0.95)| fit | upr | lwr | |

|---|---|---|---|

| Jan 1990 | 338971.3 | 362386.4 | 315556.2 |

| Feb 1990 | 320877.9 | 347051.8 | 294704.1 |

| Mar 1990 | 362740.1 | 391587.4 | 333892.9 |

| Apr 1990 | 366248.5 | 397711.4 | 334785.5 |

| May 1990 | 393696.9 | 427736.7 | 359657.1 |

| Jun 1990 | 390927.3 | 427518.3 | 354336.2 |

| Jul 1990 | 403537.7 | 442664.2 | 364411.2 |

| Aug 1990 | 424388.4 | 466041.9 | 382734.9 |

| Sep 1990 | 366408.6 | 410586.3 | 322230.9 |

| Oct 1990 | 391646.1 | 438349.7 | 344942.5 |

| Nov 1990 | 380564.1 | 429798.8 | 331329.4 |

| Dec 1990 | 349470.4 | 401244.2 | 297696.5 |

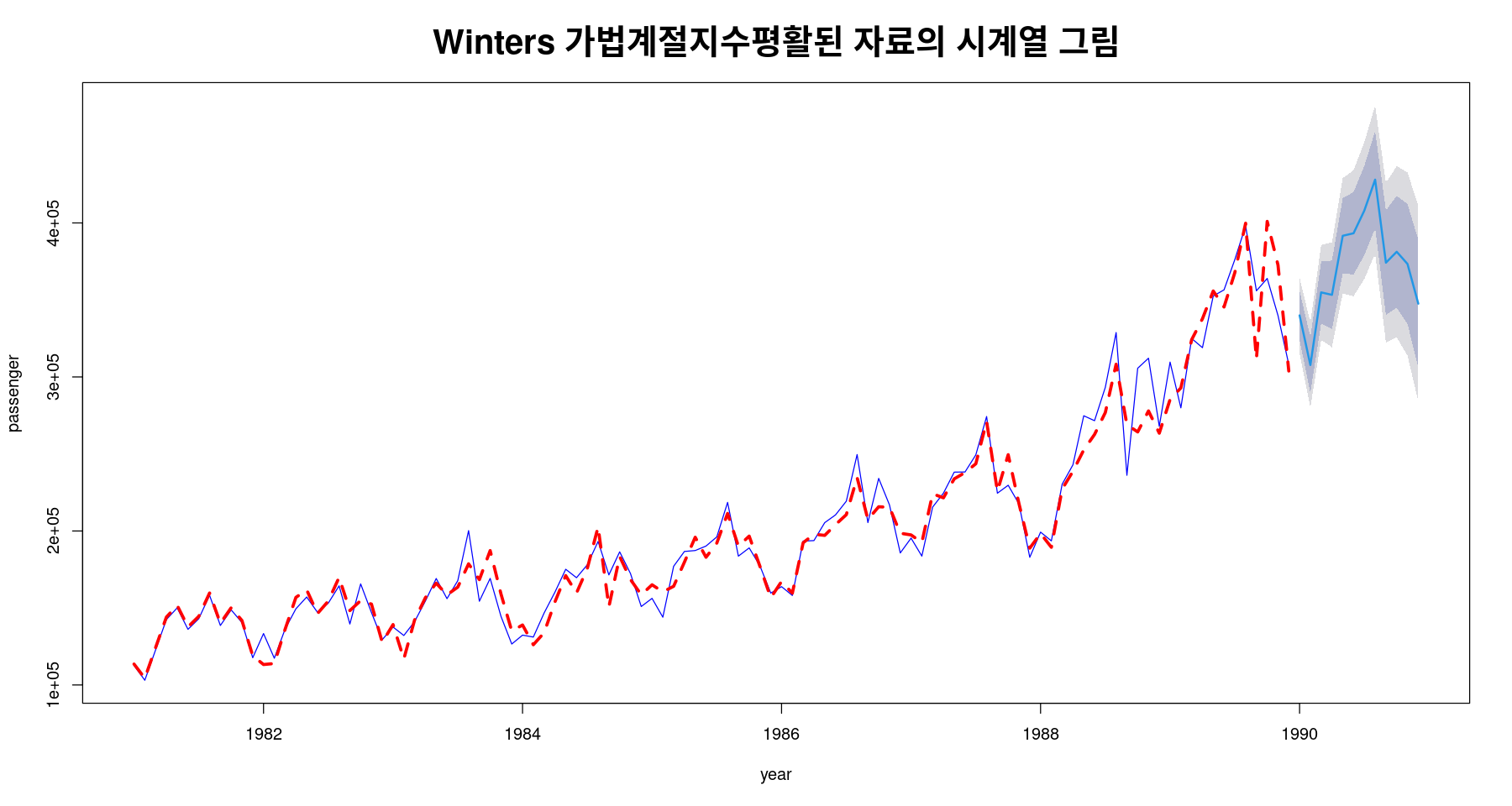

fit6= hw(pass,

alpha = fit_hw$alpha,

beta = fit_hw$beta,

gamma = fit_hw$gamma,

seasonal="additive",

initial="simple",

h=12)

fit6$modelHolt-Winters' additive method

Call:

hw(y = pass, h = 12, seasonal = "additive", initial = "simple",

Call:

alpha = fit_hw$alpha, beta = fit_hw$beta, gamma = fit_hw$gamma)

Smoothing parameters:

alpha = 0.4811

beta = 0.0383

gamma = 0.7346

Initial states:

l = 134510.75

b = 874.0694

s = -16817.75 6028.25 14250.25 4115.25 23712.25 8522.25

1617.25 15553.25 7985.25 -11710.75 -31440.75 -21814.75

sigma: 12483.69fit6 Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Jan 1990 339962.9 323964.4 355961.4 315495.3 364430.4

Feb 1990 307759.0 289731.1 325786.9 280187.7 335330.3

Mar 1990 354907.1 334791.7 375022.5 324143.3 385670.9

Apr 1990 353308.1 331046.6 375569.6 319262.1 387354.2

May 1990 391666.8 367200.6 416133.1 354249.0 429084.7

Jun 1990 393291.1 366562.0 420020.2 352412.5 434169.7

Jul 1990 408050.5 379001.1 437099.9 363623.2 452477.8

Aug 1990 428126.3 396699.7 459552.8 380063.5 476189.1

Sep 1990 374195.2 340335.6 408054.7 322411.4 425978.9

Oct 1990 381277.1 344929.5 417624.7 325688.2 436866.0

Nov 1990 373366.6 334476.8 412256.5 313889.7 432843.5

Dec 1990 347593.0 306107.7 389078.3 284146.7 411039.3plot(fit6, ylab="passenger", xlab="year", lty=1, col="blue",

main="Winters 가법계절지수평활된 자료의 시계열 그림",

cex.main=2)

lines(fit6$fitted, lwd=3, col='red', lty=2)

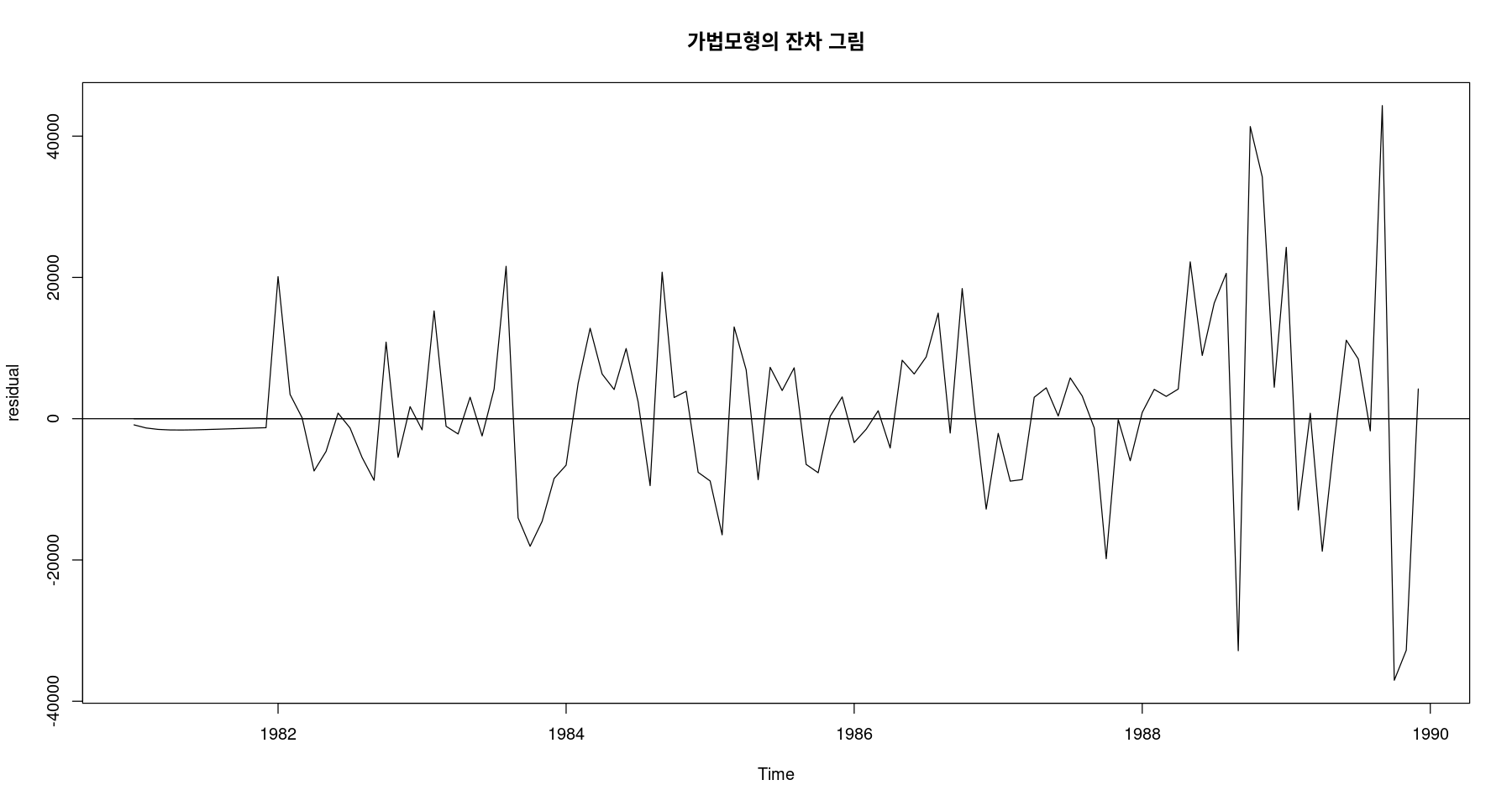

ts.plot(fit6$residual, ylab="residual",

main="가법모형의 잔차 그림",

cex.main=2); abline(h=0)

dwtest(lm(fit6$residual~1), alternative = 'two.sided')

Durbin-Watson test

data: lm(fit6$residual ~ 1)

DW = 1.9794, p-value = 0.9139

alternative hypothesis: true autocorrelation is not 0fit_hw_m <- HoltWinters(pass, seasonal="multiplicative")

fit_hw_mHolt-Winters exponential smoothing with trend and multiplicative seasonal component.

Call:

HoltWinters(x = pass, seasonal = "multiplicative")

Smoothing parameters:

alpha: 0.5623303

beta : 0.03452066

gamma: 0.3506508

Coefficients:

[,1]

a 3.560417e+05

b 3.517556e+03

s1 9.199511e-01

s2 8.489190e-01

s3 9.796617e-01

s4 1.016528e+00

s5 1.095078e+00

s6 1.060795e+00

s7 1.089621e+00

s8 1.178393e+00

s9 9.706046e-01

s10 1.065056e+00

s11 9.983082e-01

s12 8.552947e-01predict(fit_hw_m, n.ahead=12, prediction.interval = T, level=0.95)| fit | upr | lwr | |

|---|---|---|---|

| Jan 1990 | 330777.0 | 346829.6 | 314724.3 |

| Feb 1990 | 308222.8 | 328288.3 | 288157.4 |

| Mar 1990 | 359138.5 | 385415.3 | 332861.7 |

| Apr 1990 | 376229.1 | 406856.5 | 345601.8 |

| May 1990 | 409153.3 | 445160.0 | 373146.6 |

| Jun 1990 | 400075.7 | 438217.8 | 361933.6 |

| Jul 1990 | 414780.3 | 456969.6 | 372591.0 |

| Aug 1990 | 452717.7 | 501167.0 | 404268.5 |

| Sep 1990 | 376303.1 | 419627.5 | 332978.8 |

| Oct 1990 | 416668.2 | 466954.3 | 366382.1 |

| Nov 1990 | 394067.0 | 444265.0 | 343869.1 |

| Dec 1990 | 340623.2 | 383998.5 | 297247.9 |

- 예측

(135375.1+769.6180)*0.9434021xhat = (level+trend)*season

fit_hw_m$fitted| xhat | level | trend | season | |

|---|---|---|---|---|

| Jan 1982 | 128439.2 | 135375.1 | 769.6180 | 0.9434021 |

| Feb 1982 | 115639.6 | 139095.7 | 871.4889 | 0.8261910 |

| Mar 1982 | 136017.4 | 141150.4 | 912.3332 | 0.9574463 |

| Apr 1982 | 149518.1 | 142234.0 | 918.2449 | 1.0444694 |

| May 1982 | 157061.6 | 143129.5 | 917.4625 | 1.0903497 |

| Jun 1982 | 147301.4 | 144070.4 | 918.2707 | 1.0159511 |

| Jul 1982 | 153718.4 | 144910.4 | 915.5686 | 1.0541223 |

| Aug 1982 | 168929.0 | 145526.0 | 905.2115 | 1.1536408 |

| Sep 1982 | 145356.8 | 144200.2 | 828.1961 | 1.0022647 |

| Oct 1982 | 152328.4 | 141789.5 | 716.3873 | 1.0689275 |

| Nov 1982 | 151308.0 | 149505.0 | 958.0018 | 1.0056162 |

| Dec 1982 | 124771.8 | 148084.2 | 875.8840 | 0.8376189 |

| Jan 1983 | 145221.4 | 152064.5 | 983.0515 | 0.9488645 |

| Feb 1983 | 123699.8 | 148553.4 | 827.9091 | 0.8280811 |

| Mar 1983 | 149535.4 | 155104.7 | 1025.4840 | 0.9577609 |

| Apr 1983 | 158835.4 | 151223.3 | 856.0960 | 1.0444242 |

| May 1983 | 164154.8 | 149769.4 | 776.3532 | 1.0903980 |

| Jun 1983 | 156407.8 | 153110.0 | 864.8720 | 1.0158013 |

| Jul 1983 | 162915.9 | 153780.1 | 858.1482 | 1.0535292 |

| Aug 1983 | 181695.3 | 157217.9 | 947.2020 | 1.1487696 |

| Sep 1983 | 167826.2 | 167237.0 | 1260.3691 | 0.9960164 |

| Oct 1983 | 175269.4 | 160900.9 | 998.1329 | 1.0825849 |

| Nov 1983 | 159827.9 | 158745.8 | 889.2831 | 1.0012074 |

| Dec 1983 | 127751.9 | 151079.0 | 593.9197 | 0.8422859 |

| Jan 1984 | 142532.5 | 150897.2 | 567.1406 | 0.9410302 |

| Feb 1984 | 121903.3 | 145386.7 | 357.3392 | 0.8364204 |

| Mar 1984 | 144778.3 | 151942.5 | 571.3136 | 0.9492795 |

| Apr 1984 | 160473.4 | 153685.4 | 611.7569 | 1.0400279 |

| May 1984 | 169547.0 | 154175.9 | 607.5694 | 1.0953819 |

| Jun 1984 | 160803.2 | 157650.1 | 706.5277 | 1.0154502 |

| Jul 1984 | 173694.6 | 163258.5 | 875.7438 | 1.0582471 |

| Aug 1984 | 195138.7 | 166434.3 | 955.1427 | 1.1657766 |

| Sep 1984 | 164547.1 | 166439.3 | 922.3449 | 0.9831827 |

| Oct 1984 | 185610.3 | 171326.4 | 1059.2090 | 1.0767162 |

| Nov 1984 | 171413.6 | 172820.4 | 1074.2210 | 0.9857326 |

| Dec 1984 | 147645.7 | 174444.8 | 1093.2124 | 0.8411041 |

| Jan 1985 | 166446.4 | 177748.5 | 1169.5180 | 0.9302943 |

| Feb 1985 | 146908.1 | 172748.6 | 956.5467 | 0.8457327 |

| Mar 1985 | 164250.1 | 171776.8 | 889.9809 | 0.9512544 |

| Apr 1985 | 188619.2 | 180247.0 | 1151.6551 | 1.0398045 |

| May 1985 | 199768.4 | 180357.0 | 1115.6953 | 1.1008179 |

| Jun 1985 | 180180.9 | 175101.4 | 895.7550 | 1.0237712 |

| Jul 1985 | 193953.7 | 181503.7 | 1085.8446 | 1.0622383 |

| Aug 1985 | 215179.5 | 183742.8 | 1125.6531 | 1.1639604 |

| Sep 1985 | 185692.7 | 186501.6 | 1182.0312 | 0.9893921 |

| Oct 1985 | 202200.9 | 186523.2 | 1141.9731 | 1.0774556 |

| Nov 1985 | 179243.3 | 180777.1 | 904.1926 | 0.9865810 |

| Dec 1985 | 153140.0 | 180587.9 | 866.4476 | 0.8439588 |

| Jan 1986 | 172106.7 | 185806.6 | 1016.6913 | 0.9212270 |

| Feb 1986 | 153977.5 | 181780.9 | 842.6228 | 0.8431417 |

| Mar 1986 | 179279.4 | 185389.7 | 938.1127 | 0.9621723 |

| Apr 1986 | 203305.2 | 194607.3 | 1223.9257 | 1.0381655 |

| May 1986 | 208927.8 | 190651.8 | 1045.1284 | 1.0898863 |

| Jun 1986 | 197018.2 | 189880.8 | 982.4368 | 1.0322479 |

| Jul 1986 | 212180.6 | 198172.2 | 1234.7474 | 1.0640578 |

| Aug 1986 | 238655.1 | 203183.2 | 1365.1045 | 1.1667422 |

| Sep 1986 | 208779.2 | 209829.1 | 1547.4027 | 0.9877122 |

| Oct 1986 | 224934.7 | 209476.6 | 1481.8151 | 1.0662514 |

| Nov 1986 | 214191.6 | 215814.8 | 1649.4602 | 0.9849507 |

| Dec 1986 | 187470.3 | 219018.0 | 1703.0961 | 0.8493540 |

| Jan 1987 | 202258.4 | 219564.9 | 1663.1842 | 0.9142529 |

| Feb 1987 | 184970.6 | 216976.5 | 1516.4157 | 0.8465751 |

| Mar 1987 | 213274.2 | 217628.3 | 1486.5694 | 0.9733442 |

| Apr 1987 | 228708.4 | 220414.6 | 1531.4390 | 1.0304682 |

| May 1987 | 240375.6 | 219675.2 | 1453.0466 | 1.0870415 |

| Jun 1987 | 230858.4 | 220003.3 | 1414.2138 | 1.0426382 |

| Jul 1987 | 242751.4 | 225433.2 | 1552.8376 | 1.0694549 |

| Aug 1987 | 272726.7 | 230482.5 | 1673.5374 | 1.1747561 |

| Sep 1987 | 231155.7 | 232912.5 | 1699.6504 | 0.9852673 |

| Oct 1987 | 249317.1 | 230829.5 | 1569.0702 | 1.0727996 |

| Nov 1987 | 220386.3 | 222107.5 | 1213.8155 | 0.9868577 |

| Dec 1987 | 189030.6 | 221719.9 | 1158.5349 | 0.8481333 |

| Jan 1988 | 199905.9 | 218812.4 | 1018.1716 | 0.9093637 |

| Feb 1988 | 186408.5 | 219426.2 | 1004.2127 | 0.8456572 |

| Mar 1988 | 220678.5 | 225189.2 | 1168.4887 | 0.9749107 |

| Apr 1988 | 239733.3 | 231942.0 | 1361.2624 | 1.0275610 |

| May 1988 | 256712.8 | 235065.2 | 1422.0871 | 1.0855245 |

| Jun 1988 | 259416.0 | 245858.0 | 1745.5700 | 1.0477070 |

| Jul 1988 | 275036.2 | 254142.5 | 1971.2982 | 1.0738826 |

| Aug 1988 | 315076.2 | 265667.0 | 2301.0825 | 1.1757973 |

| Sep 1988 | 271768.2 | 274543.1 | 2528.0540 | 0.9808608 |

| Oct 1988 | 273789.7 | 256655.7 | 1823.2999 | 1.0592337 |

| Nov 1988 | 273615.5 | 275399.5 | 2407.4071 | 0.9849124 |

| Dec 1988 | 255666.9 | 299816.0 | 3167.1744 | 0.8438321 |

| Jan 1989 | 285956.7 | 311166.6 | 3449.6732 | 0.9089063 |

| Feb 1989 | 283426.4 | 329277.5 | 3955.7888 | 0.8505344 |

| Mar 1989 | 328551.3 | 330930.3 | 3876.2862 | 0.9813167 |

| Apr 1989 | 346538.9 | 332750.4 | 3805.3046 | 1.0296631 |

| May 1989 | 356260.4 | 321526.7 | 3286.4962 | 1.0968162 |

| Jun 1989 | 344118.9 | 322937.6 | 3221.7479 | 1.0550639 |

| Jul 1989 | 364618.5 | 332782.7 | 3450.3919 | 1.0844217 |

| Aug 1989 | 409371.2 | 342246.0 | 3657.9609 | 1.1834823 |

| Sep 1989 | 330102.0 | 340538.5 | 3472.7404 | 0.9595674 |

| Oct 1989 | 391103.1 | 359147.7 | 3995.2609 | 1.0769949 |

| Nov 1989 | 354111.2 | 348968.1 | 3505.9370 | 1.0046446 |

| Dec 1989 | 295543.2 | 344512.4 | 3231.0940 | 0.8498887 |

fit7= hw(pass,

alpha = fit_hw_m$alpha,

beta = fit_hw_m$beta,

gamma = fit_hw_m$gamma,

seasonal="multiplicative",

initial="simple",

h=12)

fit7$modelHolt-Winters' multiplicative method

Call:

hw(y = pass, h = 12, seasonal = "multiplicative", initial = "simple",

Call:

alpha = fit_hw_m$alpha, beta = fit_hw_m$beta, gamma = fit_hw_m$gamma)

Smoothing parameters:

alpha = 0.5623

beta = 0.0345

gamma = 0.3507

Initial states:

l = 134510.75

b = 874.0694

s = 0.875 1.0448 1.1059 1.0306 1.1763 1.0634

1.012 1.1156 1.0594 0.9129 0.7663 0.8378

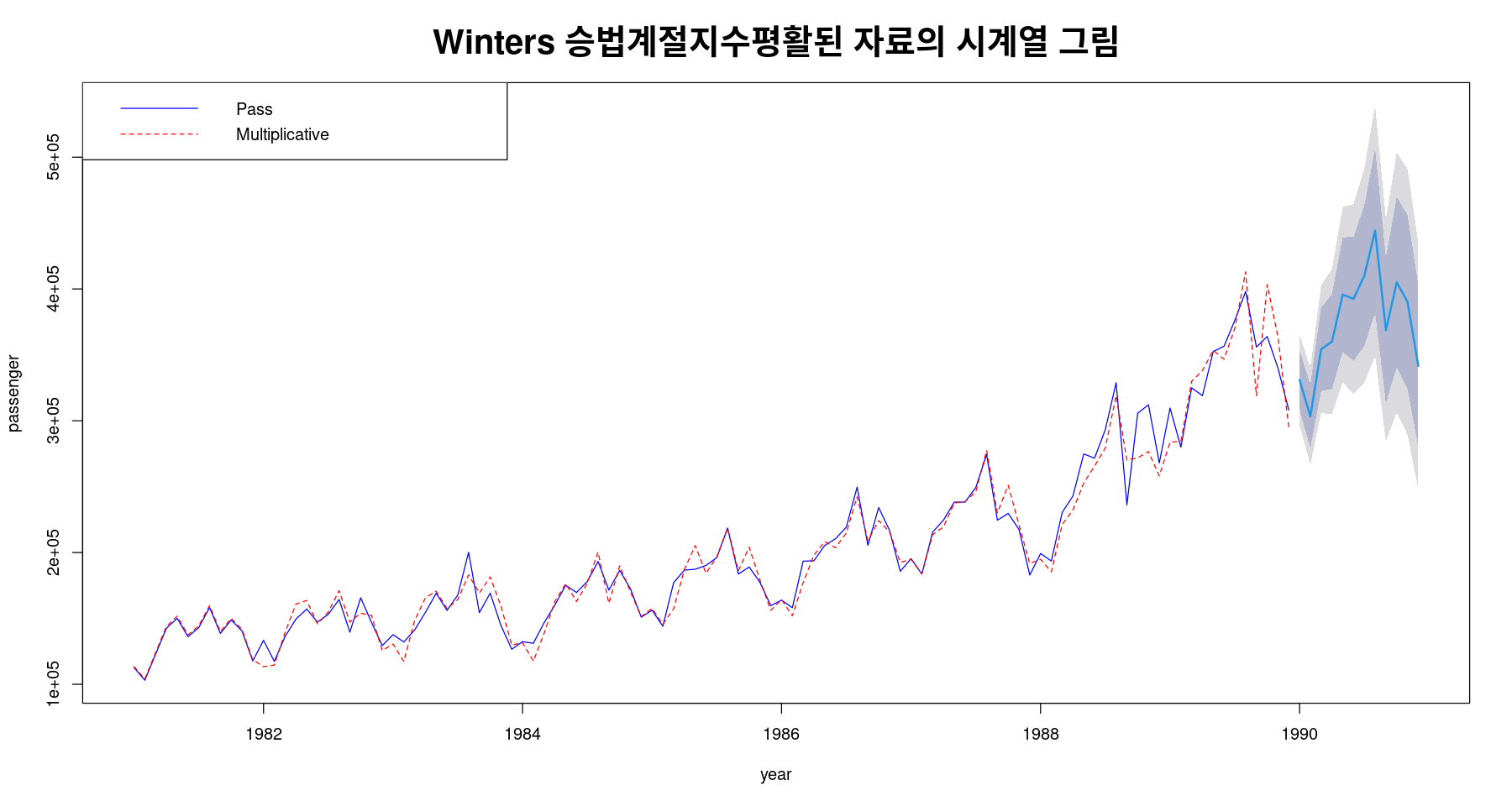

sigma: 0.053plot(fit7, ylab="passenger", xlab="year", lty=1, col="blue",

main="Winters 승법계절지수평활된 자료의 시계열 그림",

cex.main=2)

lines(fit7$fitted, col="red", lty=2)

legend("topleft", lty=1:2, col=c("blue","red"), c("Pass", "Multiplicative"))

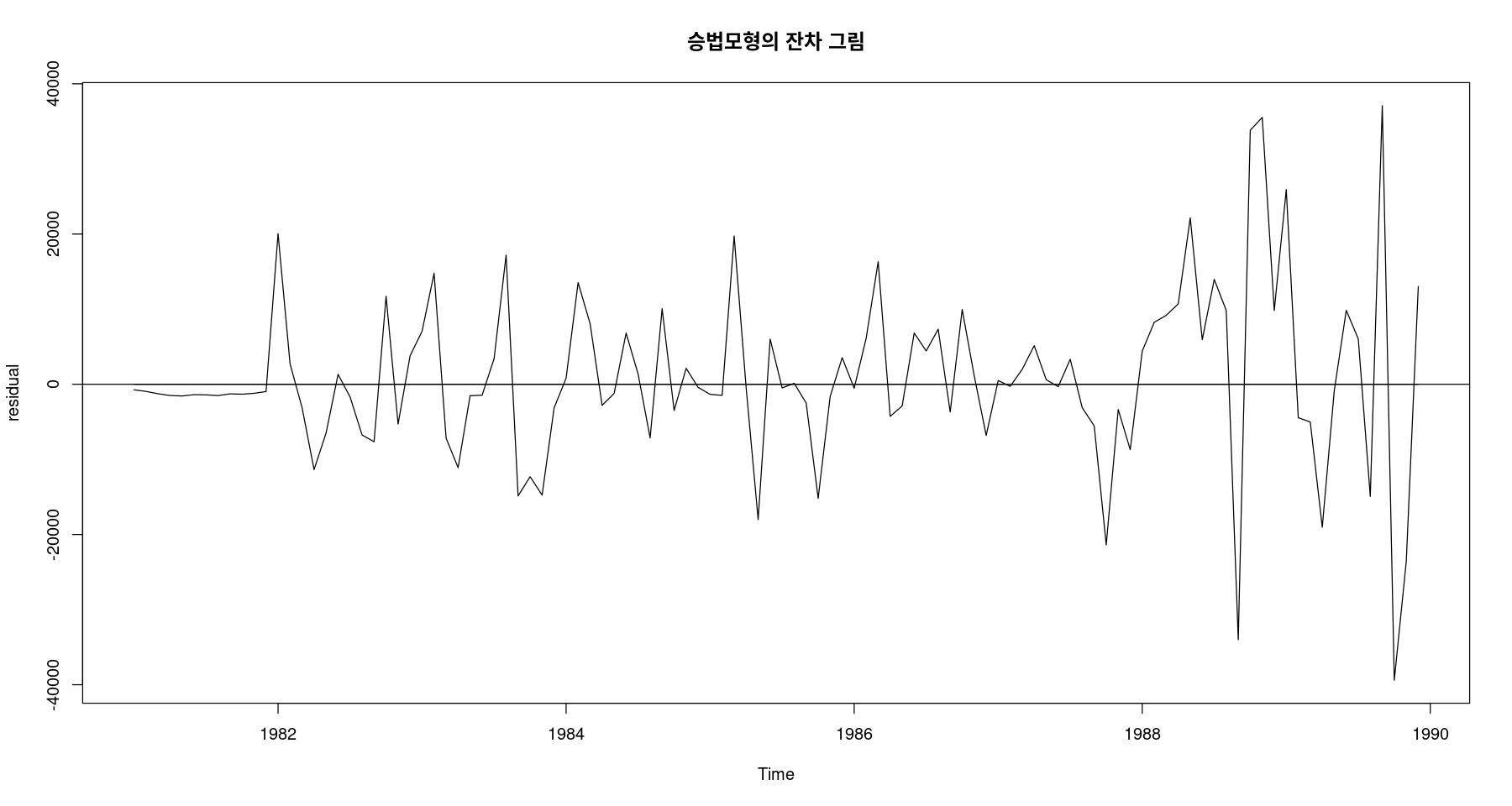

ts.plot(fit7$residual, ylab="residual",

main="승법모형의 잔차 그림",

cex.main=2); abline(h=0)

dwtest(lm(fit7$residual~1), alternative = 'two.sided')

Durbin-Watson test

data: lm(fit7$residual ~ 1)

DW = 1.9744, p-value = 0.8931

alternative hypothesis: true autocorrelation is not 0fit_hw$SSEfit_hw_m$SSE가법과 승법 모형의 SSE를 비교해서 SSE값이 더 작은 모형을 선택해 주자.

단순지수평활: HoltWinters(beta=gamma=FALSE), ses: 추세도 없고 계절성분도 없어보일 때 사용

이중지수평활: HoltWinters(gamma=FALSE), holt: 추세가 있을 때 사용

계절지수평활: HoltWinters(), hw: 계절 성분 있을 때 사용

위의 함수를 사용하기 전에 가장 먼저 시도표를 보자!